Jason Wong won’t add a new app to his eCommerce store unless it meets his carefully-set conditions.

It has to optimize at least one of the three variables he cares most about, Jason explained on smile.io’s “What’s Your eComm Stack?” podcast : customer retention rate, conversion rate, or AOV.

Jason runs Doe Lashes , a beauty-focused eComm store, and he’s just one of many retailers who are faced with limitless possibilities when it comes to choosing their tech stacks—and who are being extra judicious about what apps they’re bringing onboard, and why.

Buy > build, but check out that price tag

Let’s take a little trip through eComm tech history, guided by Digital Shelf Institute’s interview with Dr. Adam Ferrari , a retail tech expert with 14 eComm patents to his name:

Early 2000s: primitive, home-built tech stacks with rudimentary search capabilities

Early 2010s: a divided field, with SMBs choosing off-the-shelf solutions and cobbling them together into an eComm store and bigger retailers building custom platforms. “The early days of the tech stack were changing very quickly. Replatforming was the constant thing, just by the necessity of web technologies,” explained Dr. Ferrari.

Early 2020s: application programming interfaces (APIs) have enabled a permanent shift to headless commerce, giving retailers a way to add extra features without having to redo their entire site—and a path to keep capitalizing on mobile-first shopping. "You see all the commerce platforms being influenced by the headless trend and providing better API capabilities because there's just a greater desire to deliver innovative shopping experiences," said Dr. Ferrari.

Retailers are no longer asking themselves whether they should build their own platforms or buy off-the-shelf solutions. Their credit cards are out, and buying is happening.

But to what extent? When is endless customization and personalization and innovation worth the cost?

Blissfully’s 2020 report on SaaS app use across over 1,000 companies found that:

The cost to buy is going up: Companies are spending 50% more on SaaS products, year over year

Tech stacks are getting more and more complex: Companies are using 30% more unique apps, year over year; the average enterprise used 288 apps in 2019!

Prices are outpacing the number of new apps: Whether they’re adding more users (and thus user fees), upgrading to higher-cost versions, or simply dealing with app vendors who are raising their fees, companies are spending more money even when they’re not adding more apps

There are still significant (and expensive) costs of disorganization, failure, and churn: Less than 70% of the apps companies bring on in a given year are still in use the next year, and companies are paying for, on average, 3.6 duplicate apps and 2.7 orphaned app subscriptions

Modern Retail reported on the rising “eCommerce tax,” or the percentage of gross merchandise volume spent on things like cybersecurity, cloud migrations, and retail services.

The average business spends 8.2% of revenue on tech spend, and for eComm retailers, that number is even higher, coming in at 13.3%. (And it doesn’t need to be: industry experts say that up to 30% of tech spend is wasted.)

That means a business that clears $10 million in sales is paying $1.3 million in the tech that supports it.

Tech spend and eCommerce taxes will only keep rising, according to the experts, because it’s hard to have clear visibility into exactly what you’re paying across each app, each subscription, and each plug-in.

Understanding what you’re buying—and why

Going back to our example from the beginning, Jason of Doe Lashes shared the 13 apps he most recommends for running an eComm site, which included everything from building a custom reviews system (Okendo ) to running email and SMS campaigns (Klaviyo ).

Each one falls into his framework, helping to answer one of his three key questions:

“Can we get people to come back by driving better experiences” (and drive up customer retention rate)?

“Can we do things on a website to increase the chances of someone to make a purchase” (and increase conversion rates)?

“Can we do something on our website to make people want to buy more items” (and increase AOV)?

But even when apps meet those goals, they can still be hard to manage—and have questionable ROI.

There are plenty of good things that come from a fully-bought tech stack, including scalability, customization, and increased functionality. But they come with pain points and costs, too, including:

Increased tech spend and churn. “Sometimes [apps] don't talk to each other, and that's the sad part because you end up having to use a lot more apps to make [it work,] so eventually, your app list just becomes longer and longer,” said Jason. “I’d like to see more apps work with each other rather than against each other if they're offering different stuff. And making sure that they're able to sync their data across each other to help the merchant at the end of the day.”

Additional security risk. For each employee that’s using each app, companies are introducing risks of weak passwords, loose security settings, account sharing, and complicated deactivation protocols, per Blissfully . That’s on top of having to deal with national and industry regulations around data privacy, which are harder to follow when you have more apps than you can stay on top of.

Worse customer experience. If you’re not careful, adding on a glut of microservices can end up slowing down load time and complicating checkout processes, meaning that for all your best intentions, your tech stack isn’t serving your bottom line.

What can we learn from this?

The importance of (1) being judicious about bringing on new apps and services (like by making sure they pass a decision framework, a la Jason’s); (2) tracking spend and access over time, to better manage bloat and security risk; and (3) getting creative about aligning app functions with costs—and more on that in the next section.

What to do with rising tech costs and rising product costs

Spending more on the tech that enables your eComm store is one thing.

Spending more on the tech that enables your eComm store while also facing unprecedented high product costs? That’s something entirely different.

As we covered last month , the combination of pandemic and climate-change related supply chain interruptions has the cost of making, acquiring, and selling goods skyrocket. They can either pass those costs onto consumers, with higher prices and shipping costs, or they can freeze prices where they are and take a haircut on those margins. Neither of those are a great option.

It’s not a good time to see tech stack costs rising. If a company that has 150 apps right now will have 225 by this time next year, they need to start asking themselves one question—a pared-down version of Jason’s framework: will this app be cash-flow positive?

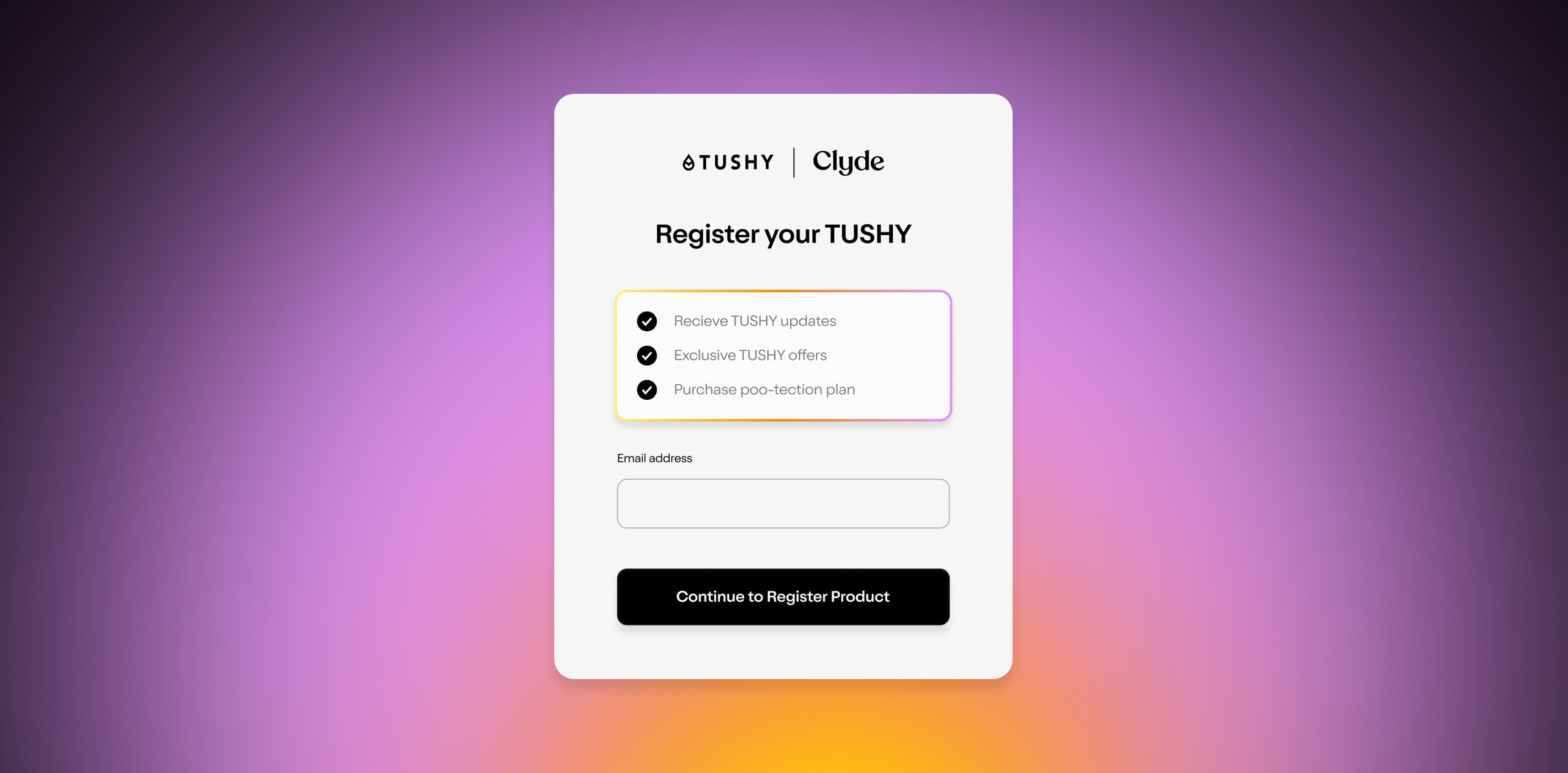

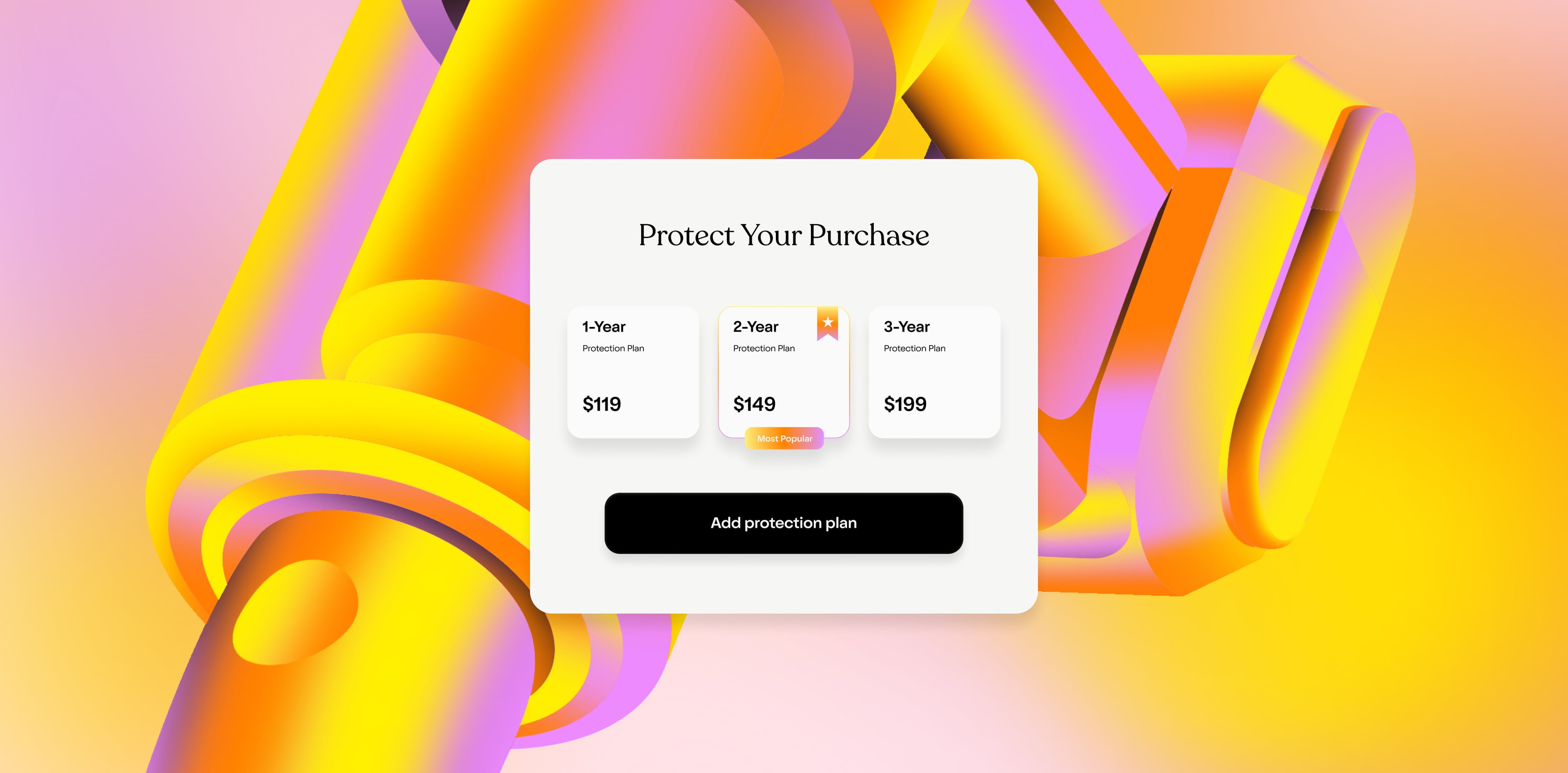

Clyde is an example of an app that brings money in. It costs nothing to use upfront, and retailers only pay a small part (their part of the premium) for each Clyde-enabled product protection plan they sell. Offering extended warranties can help drive up your margin without needing to spend more on your products or reworking supply chain. In essense, Clyde is a cash-flow-positive app that bolsters your business from the moment you launch.

Ask for a demo today to see what the tech stack of the future looks like today!

SIGN UP FOR OUR NEWSLETTER