It’s news to no one that sales has seasons. Some industries see spikes specific to their niches, like school supplies in late summer or outdoor furniture in early spring:

Top: 5-year Google search history for “school supplies,” showing peaks every July/August (and a relative peak in 2020 due to COVID-induced remote learning. Bottom: 5-year Google search history for “outdoor furniture,” showing peaks every April/May (and an outsized peak in 2020, again due to the coronavirus pandemic)

But across the board, for nearly every category of product, eCommerce sees its biggest season happen during the last two months of the year.

Starting with the Cyber Five—the five-day period from Thanksgiving to Cyber Monday—sales usually stay strong up until the end of December/early January, when most holiday celebrations have ended. Then, with shoppers wiped out from major expenditures in the fourth quarter, the first quarter of the new year tends to look pretty dismal. Annual eCommerce spending looks like a wave that peaks in Q4, drops sharply in Q1, and swells slightly through Q2 and Q3 before climbing sharply again in Q4. Take a look:

In a normal year, retailers have to be patient and creative to get through off-season slumps. And 2020 isn’t a normal year.

What seasonality looks like this year and how to combat it

With economic hardship meaning that 1 in 4 Americans are planning on spending less this holiday season, even an increase in eCommerce spending may not make up for losses sustained throughout this year and early next.

So what options are left? Sales pushes could work—who says you can’t make a big marketing push for Groundhog Day?—but they’re expensive, and your customers will probably be burned out on email campaigns and banner ads.

Enter passive income.

Long a buzzy phrase in eCommerce, it usually refers to a set of low- or, ideally, no-investment-needed ways to rake in cash like dropshipping, affiliate programs, and ebook sales. And while some people and some retailers do make a killing off of those, if you’re selling consumer goods, that’s a pivot you’re unlikely to make. If your product is mattresses, you could have your content team write an ebook about sleep hygiene and start selling it. But that might not be the best move for your brand or your bottom line.

Try offering extended warranties instead.

How extended warranties work

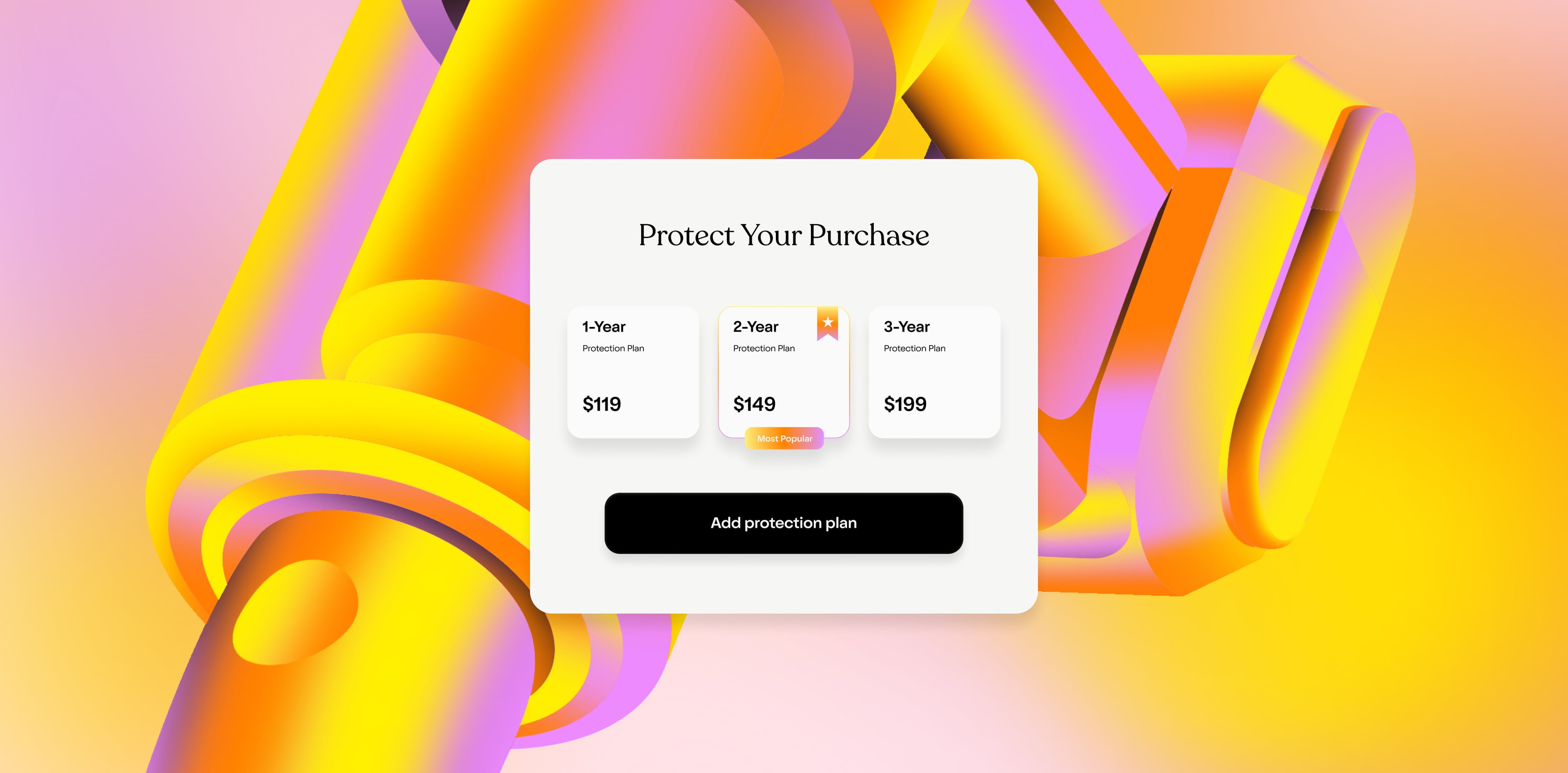

Extended warranties are what they sound like: additional product protection on top of a manufacturer’s warranty. They’re more than that, too: they’re peace of mind. If a customer breaks their product or has any sort of issue with it, they can turn to their extended warranty for help fixing the problem.

Extended warranties enhance the customer experience and the retailer’s bottom line. If there is a product issue, retailers can capture future sales by replacing or repairing it. And adding product protection options can increase AOV and improve LTV .

Passive income in action

Plans could be the highest-margin product you sell—and a truly passive source of income.

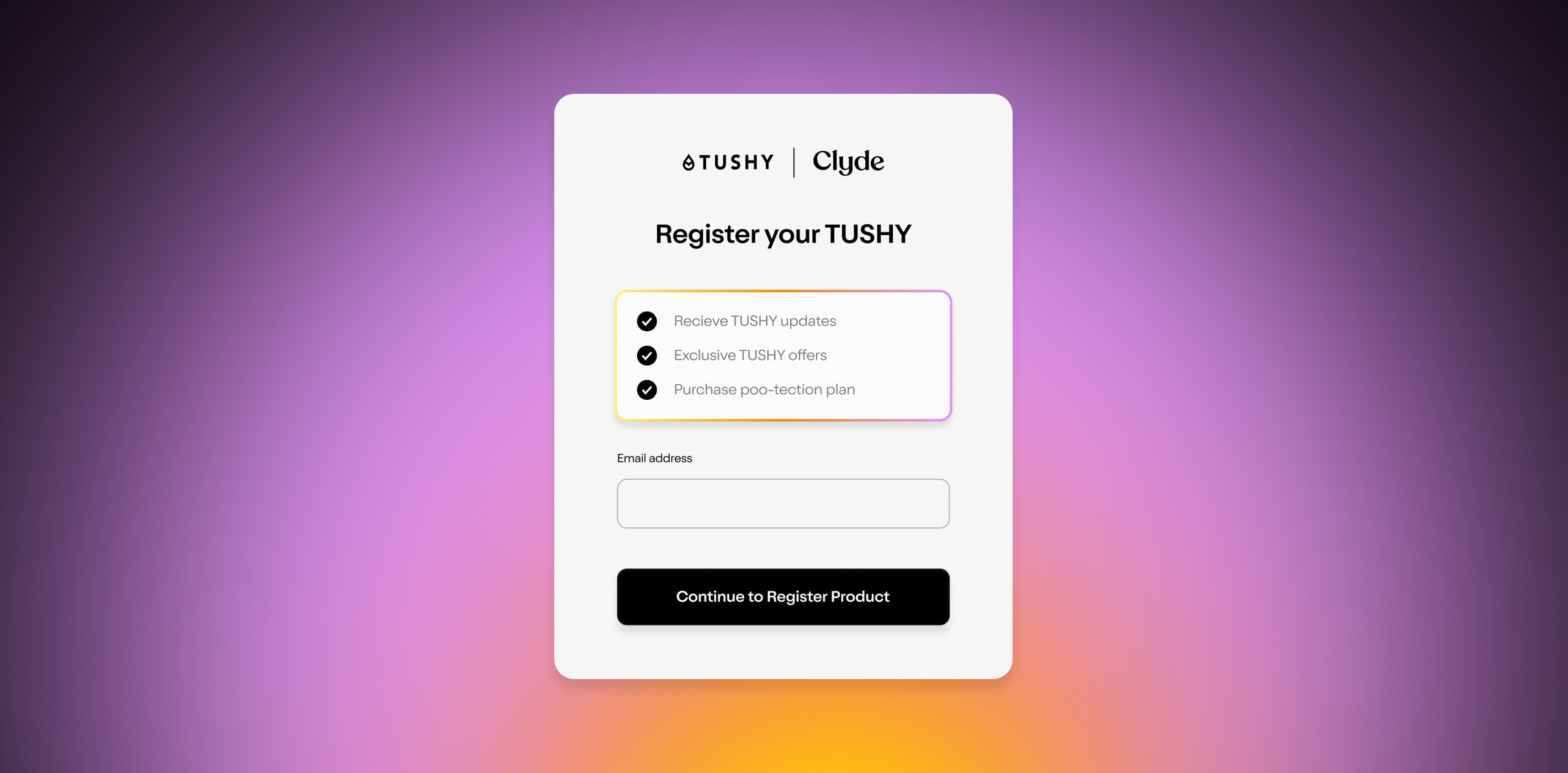

By choosing an extended warranty partner like Clyde , you can offload all of the logistics and management of the program while still reaping the profit. Our platform integrates with your website in minutes and can automatically optimize your pricing with AI autopilot functionality. When customers file a claim, they’ll do through their easy-to-navigate Clyde dashboard and we’ll oversee its resolution. You’ll get real-time transparency into your program’s results.

Generally, it takes a couple of months from when we onboard a new retailer to when they start to see the full effects of extended warranty purchases on sales numbers. There’s no better time to start a program than now. In the short term, you can capture last-minute holiday shoppers, and over the next few months, you can drive up your AOV on every sale and recoup potential lost sales from any product issues or replacements.

Let’s look at an example. Say you’re the mattress seller I mentioned in the intro. Usually, you see a decent-sized uptick in sales for the holidays from people wanting to treat themselves and their loved ones to the gift of good night sleep. If you implement an extended warranty program now, you could see jumps in your profit margin immediately. But more importantly, the sales you make in January, February, and March will get that same boost right when you need it the most, without you having to spend a single dollar in advertising, R&D, production, storage, or shipping.

Getting ahead of next season’s lull is a good idea

The Q1 slump might hit extra hard next year, thanks to the economic downturn we’ve been living through as a result of the pandemic, but the first quarter has always been the hardest time to be a retailer.

It’s long past time for innovative passive-income strategies to step to the forefront. These strategies can help shore up cash flow and ease out some of the steepness of that sales curve, and extended warranties are a great way to do that.

Learn more about how Clyde drives revenue for retailers.

SIGN UP FOR OUR NEWSLETTER