How Brands Are Prepping for BFCM (Black Friday Cyber Monday) in 2022: 3 Trends and Practical Takeaways

Is August too soon to start thinking about holiday deals?

Not if you’re a retailer.

And actually, probably not if you’re someone who wants to give gifts this year, either, considering that U.S. inflation is projected to stay close to 9% — more than three times the 20-year average — for the rest of 2022, per forecasting .

So how are brands prepping for Black Friday Cyber Monday (BFCM) season this year? That’s what we dig into here. We include analysis on 3 new 2022 trends, as well as practical takeaways for your business:

First, a primer: what is BFCM and how is it changing?

Black Friday and Cyber Monday are two of the biggest shopping days in the U.S. Black Friday is always the day after Thanksgiving; this year it takes place on November 25, 2022. It’s said to be called “Black” Friday because it’s the day that companies generate enough profit to be “back in the black” for the financial year.

Cyber Monday is the first weekday after. This year, it’s November 28, 2022.

Cyber Monday is particularly important to e-commerce retailers. It’s the biggest online shopping day of the year. In 2021, customers spent $10.7 billion on Cyber Monday — and in the day’s peak hour (11 p.m. to midnight on the east coast and 8-9 p.m. on the west coast), they spent $12 million per minute, per Adobe .

While BFCM has traditionally been the crowning moment of the holiday shopping season — call it the homecoming weekend of the general November to December holiday rush — that started to change in 2020 and 2021.

Pandemic-related pressures included consumer concerns about product availability and shipping. Pandemic-related opportunities included rising wages for consumers and economic stimulus available to both businesses and individuals.

Both sets of factors combined over the last two years to draw the holiday season forward, and that’s likely to continue.

A leading indicator: Amazon held their annual Prime Day sale in July, but industry rumors are circulating around a second Prime Day that may take place in October. (In 2020, Amazon pushed Prime Day from July to October due to the pandemic; this would be the first year there would be two events in the same year.)

A second 2022 Prime Day would allow the e-comm giant to further jump-start holiday commerce — and continue to set the pace for other brands.

And as of 6 days ago, Amazon is hiring for a senior manager focused on event promotions for Prime Day and BFCM…

For more reading and reporting: check out our our in-depth guide and trend summary on post-pandemic changes in and predictions for holiday shopping, including analysis on the impact of:

supply chain disruptions

a permanent shift to online shopping

ongoing price sensitivity

rising customer acquisition costs

email and SMS marketing

buy online, pick up in stores options

shipping pressure

and more

Trend 1: Brands are embracing a “longer, flatter” season

As covered above, the holiday season has been creeping forward for years. Brands are going to continue that trend in 2022.

And consumers are ready: 37% of American shoppers are planning to start buying gifts earlier in 2022 than in 2021.

But it’s not just a longer season — it’s one with fewer peaks, too. Per Barron reporting on Salesforce data, 51% of consumers expect to make fewer holiday purchases in 2022 compared to 2021.

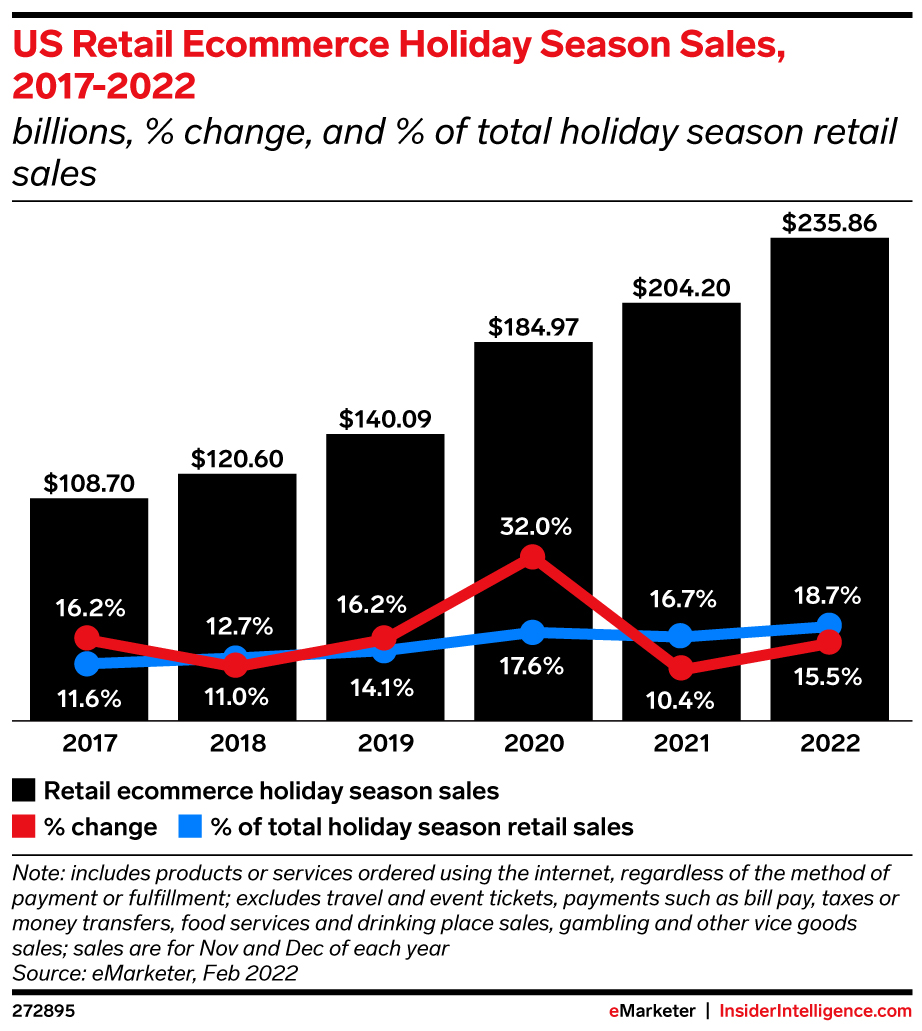

Insider calls it a “longer, flatter” season and expects to see less spending during the five days immediately surrounding BFCM. They expect to see those days’ share of holiday ecommerce sales to fall a bit, from 16.9% to 16.4% of holiday spending, but for the net sales numbers to still increase.

Practical takeaway:

Follow Codal’s suggestions (and get started even earlier, if you can!) for what you should be focused on each month leading up to BFCM to make the best of the accelerated timeline:

September: bring in new customers and plan out your offers. On the marketing side, build a drip marketing campaign, grow your email list, and invest in highly-segmented search ads. On the product side, solidify your product offerings and your pricing strategy.

October: reengage previous customers. Offer member-only early-bird deals and promotions and experiment with campaigns targeting different types of buyers.

November: execute. The time for experimenting will be over as you get this close to BFCM. Instead, hone in on the insights you’ve gained in earlier months, and make sure your logistics, fulfillment, and customer service plans (and backup plans!) are ready to capitalize on all of your hard work to bring in sales.

Trend 2: Brands are offering fewer discounts and promotions

Price slashes? Price haircuts might be a better term for 2022. Per industry analysis, the combination of inflation, higher materials cost, and strong demand means that brands aren’t planning to go promotion-crazy this holiday season.

Last year’s holiday discounts ranged from 5-25%. That represents deals that were half as good for the end consumer, compared to historical average discounts of 10-30%, according to reporting from the Washington Post .

“You’re just not seeing those discounts anymore,” said Nela Richardson, chief economist for ADP, for that story. “Demand is so high that they’re just not necessary.”

Barron’s story expects discounts of 18%, on average. Per Adobe data , that will likely look different depending on industry, going off of 2021 numbers:

12% for electronics (compared to 27% in 2020)

18% for apparel (compared to 20%)

8% for both appliances and sporting goods (compared to 20% for both)

That being said, discounts will still serve a purpose this holiday season.

And it’s mostly to reactivate your current customers versus to acquire new ones — because everyone else is going to be offering their best deals, too, it’s better to put offers and ads that will appeal to the buyers you already have.

Practical takeaway:

An ecomm ads agency shared their insights on supporting 8-figure businesses, and included the following tips for making the most of whatever discounts you do offer:

Offering “bundles” boosts AOV

High-ticket bundles won’t be purchased much — but will make other offers look better in comparison

The best-performing offers are:

Buy 2, Get 1 Free

Buy 3, Get 1 Free

Buy 1, Get 1 50% Off

Big Bundle with a Few Free Gifts

Sitewide Discount of 20%

Trend 3: Brands are lowering profit and international sales expectations due to a strong US dollar

Not all retailers sell internationally. Those that do may not expect to see particularly strong overseas sales on Black Friday Cyber Monday. (They call it American consumerism for a reason, after all.)

But many American companies do sell in international markets — and per 200+ major corporations, from Microsoft to Costco, they’re lowering their expectations for overall profits and for international sales for the rest of this year.

Bloomberg analyzed the latest earnings calls of hundreds of S&P 500 firms and found that 44% of them have told investors that the strength of the dollar compared to foreign currencies is hurting their profitability and negatively impacting their 2022 projections. (Per the New York Times , the U.S. dollar is “the strongest it has been in a generation,” having gained more than 10% this year.)

Practical takeaway:

When the dollar is stronger than other currencies, companies’ reserves are often worth less (if they’re held in foreign currencies)

Companies’ products are also less competitive, since their prices rise and they can be priced out

Of course, there’s a flip side to this news: companies that generate all of their revenue in the U.S., or internationally-based companies with strong U.S. sales, may come out on top

As a result, many U.S. brands may be focused more on domestic audiences than on international ones this holiday season

A bonus: Brands are staying optimistic

We’ve talked about some of the challenges brands need to address in 2022, but it’s not all downside news. No Scrooges here!

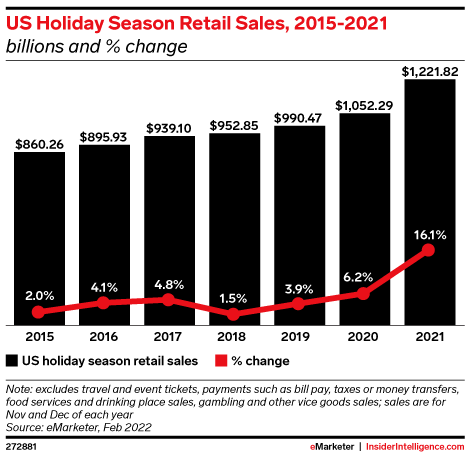

Insider is forecasting “healthy consumer spending patterns and a more stable supply chain” this holiday season — can we get a “ho, ho, ho” for that?

They’re expecting sales to increase by 3.3% to $1.26 trillion, with e-comm sales growing significantly faster (at 15.5%) than brick-and-mortar sales (0.9%).

No holiday season is easy. It’s a stressful time for everyone. And that’s especially true if you’re an e-comm business looking to maximize its profit, build the strongest relationships possible with buyers, and secure the chance to be around for many holiday seasons to come.

But you don’t have to do it alone. Clyde is here to help. Our ownership enrichment platform creates a better experience for your customers while also enriching your competitiveness and margins — and we’d love to walk you through how it works. Sign up for a Clyde demo today.

SIGN UP FOR OUR NEWSLETTER