Extended Warranty

Clyde makes it easy to offer product protection plans that boost profits and charm customers.

Easy, breezy, bountiful coverage

Discover more with Clyde

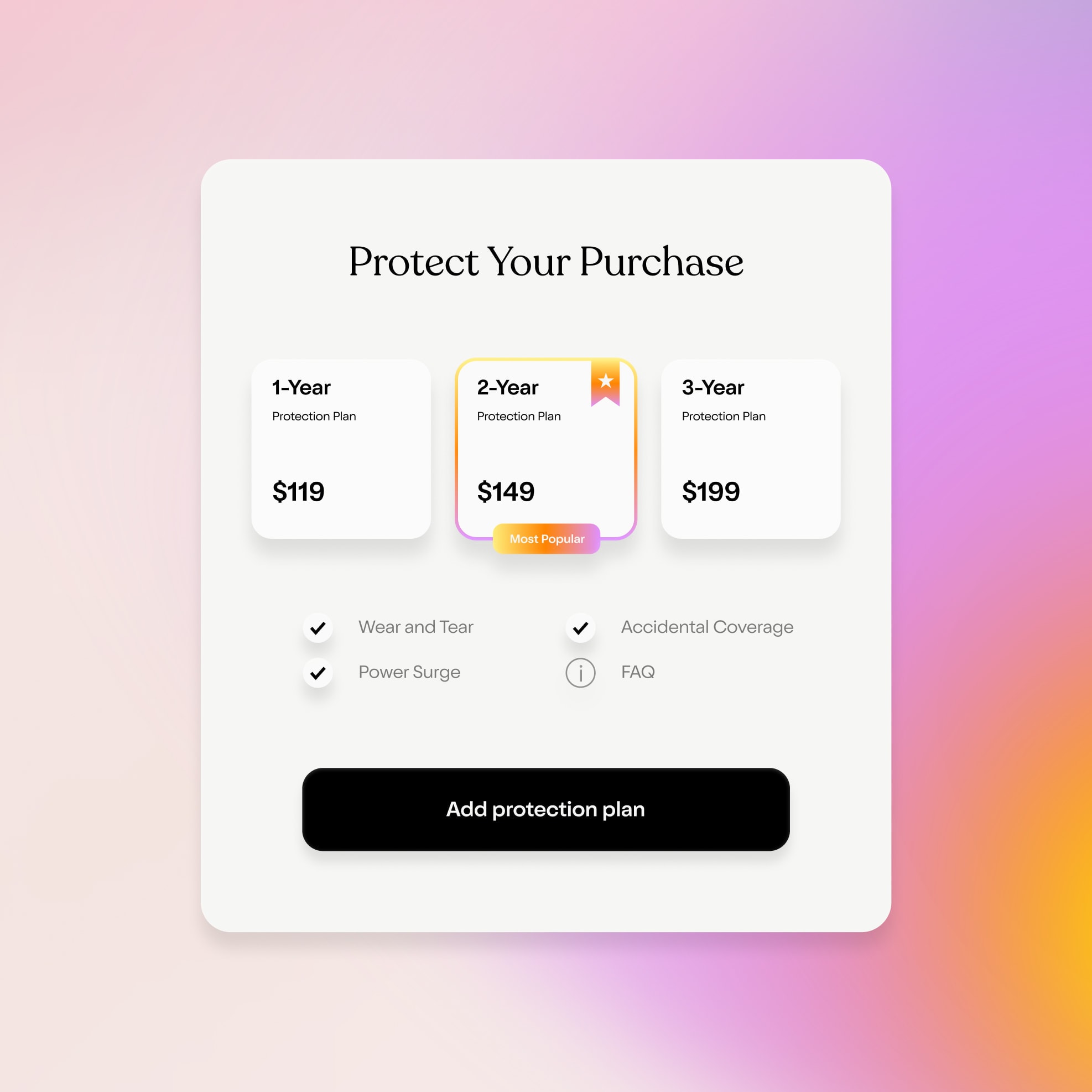

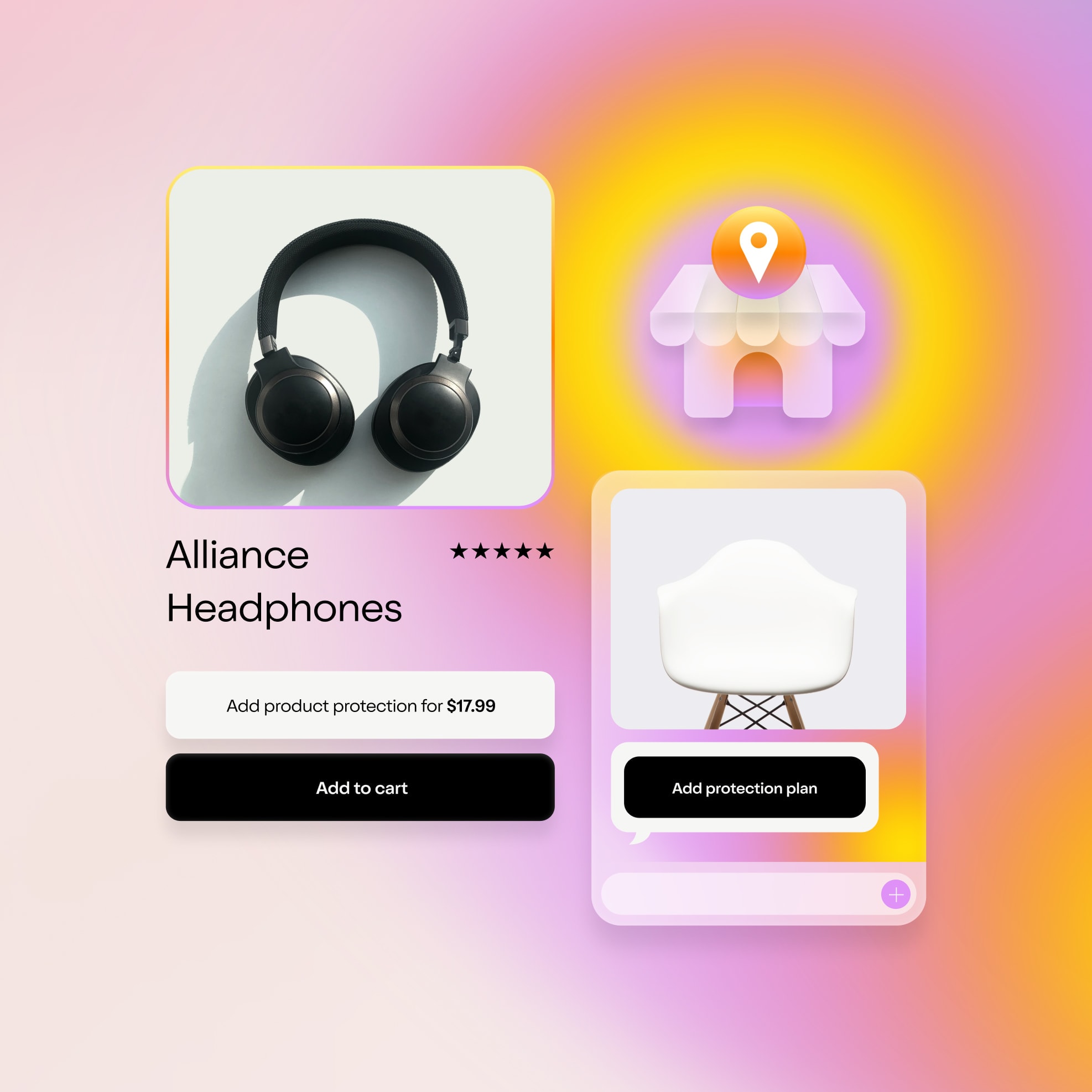

The Purchase Experience

Sell with a truly seamless shopping flow

Launch your custom ecommerce experience

Our warranty and conversion experts partner with you to design experiences specifically for your goals, from driving more top-line revenue to winning customers from competitors. With Clyde, you can count on:

- Program plans built just for your brand

- Expert guidance to optimize performance

- Integrations that enhance your tech stack

Offer your warranties (pretty much) anywhere

Meet your customers where they’re most likely to convert — from product pages to customer support channels to registration flows. With Clyde, warranty programs can be offered anywhere, across all channels:

- Mobile apps

- Checkout pages

- Product detail pages

- Customer service pages

- Customer support chats

Go beyond warranties to engage your customers

Clyde warranties are a wonderful way to identify your most committed customers and unlock additional revenue. Send fully branded post-purchase emails with promotional offers, purchase anniversary upsells, and much more:

- Free services

- Club memberships

- Monthly giveaways

- Promotional contests

- Discounts and bundles

- Cross-sells and upsells

The Purchase Experience

Sell with a truly seamless shopping flow

Our warranty and conversion experts partner with you to design experiences specifically for your goals, from driving more top-line revenue to winning customers from competitors. With Clyde, you can count on:

- Program plans built just for your brand

- Expert guidance to optimize performance

- Integrations that enhance your tech stack

The Claims Experience

Designed for customer peace of mind

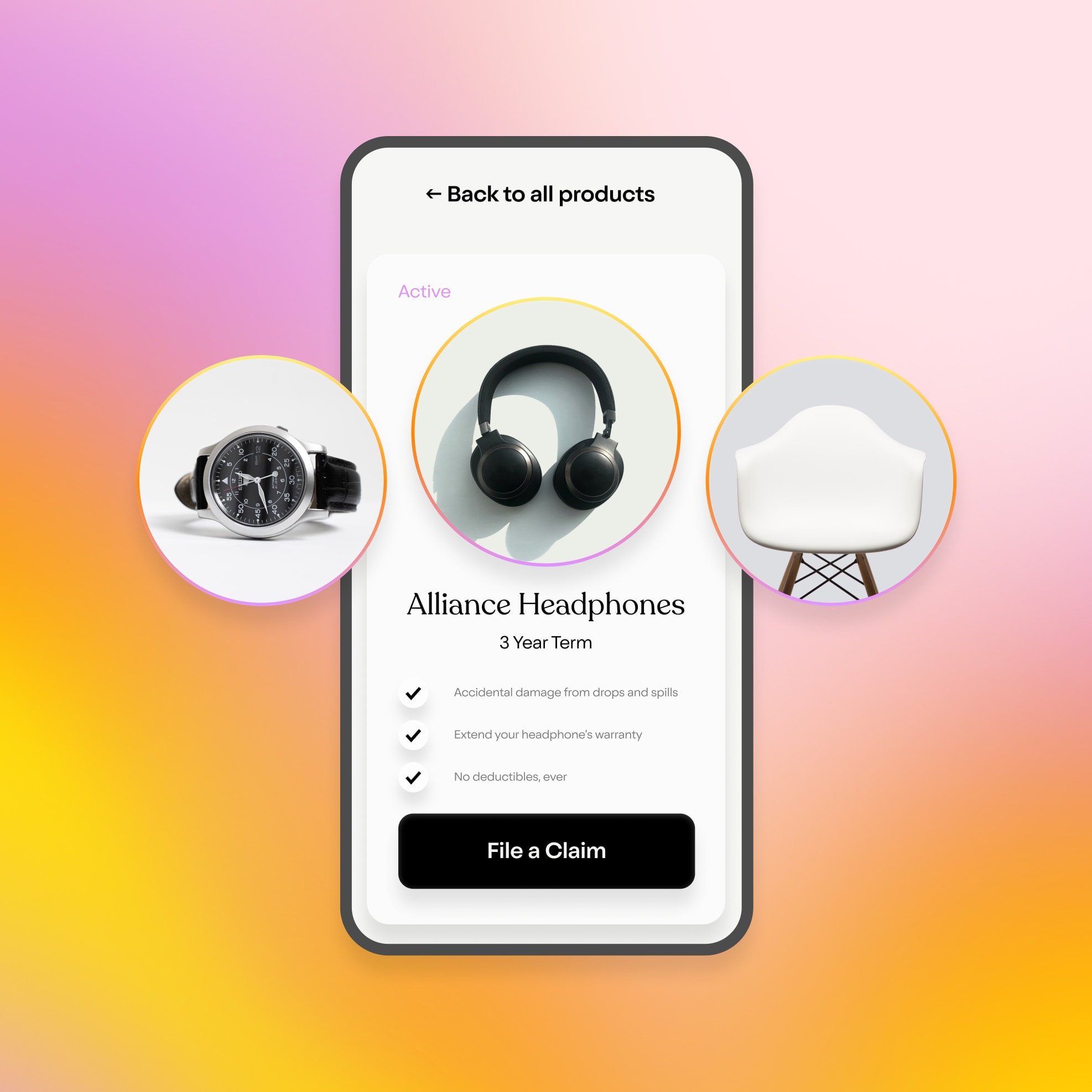

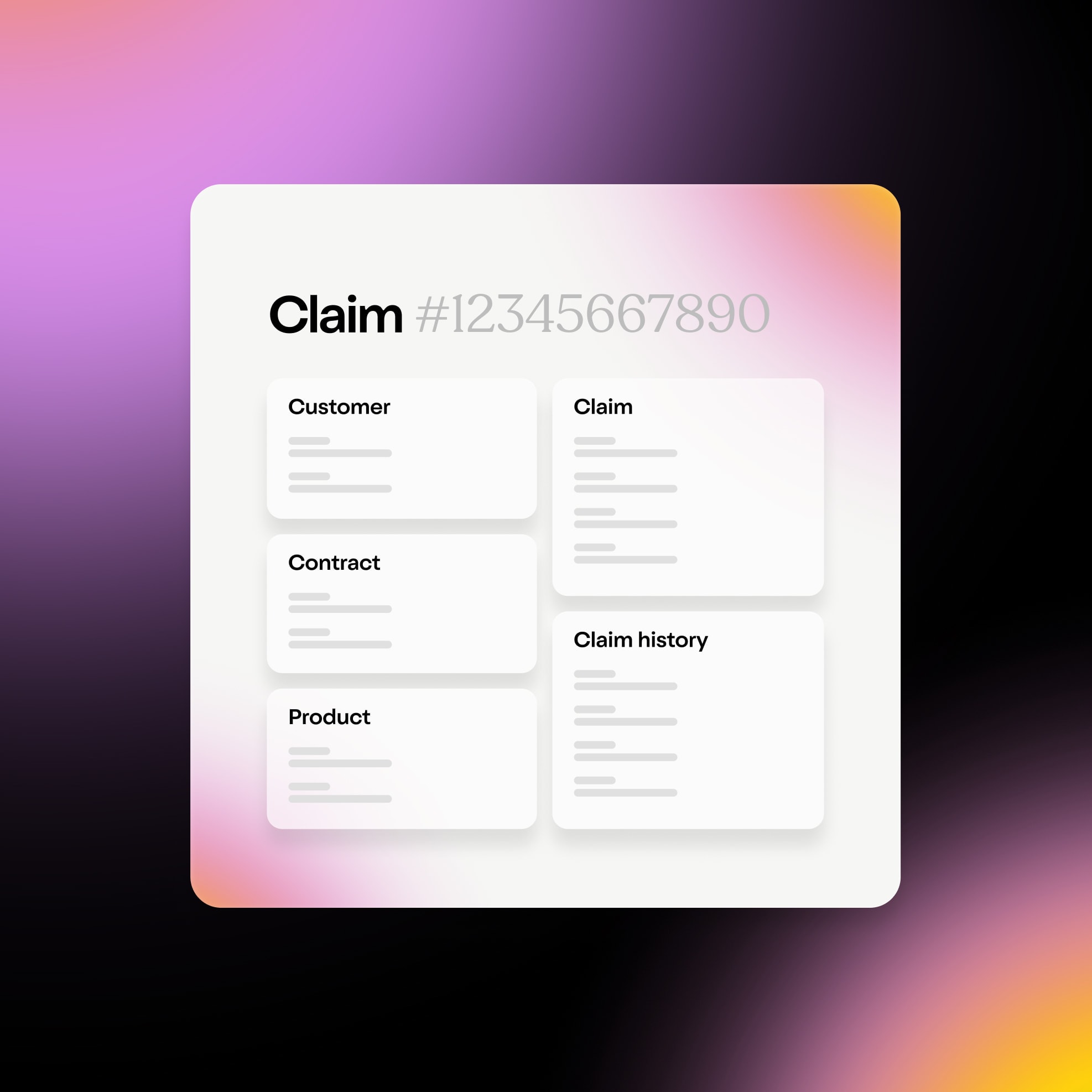

Give customers their own self-serve dashboard

Automated for you, awesome for them. Clyde saves your customer service team precious time by giving your customers instant access to their own dashboards where they can manage their products and protection plans.

- File and resolve claims

- View contracts and terms

- Buy additional coverage

- Purchase more products

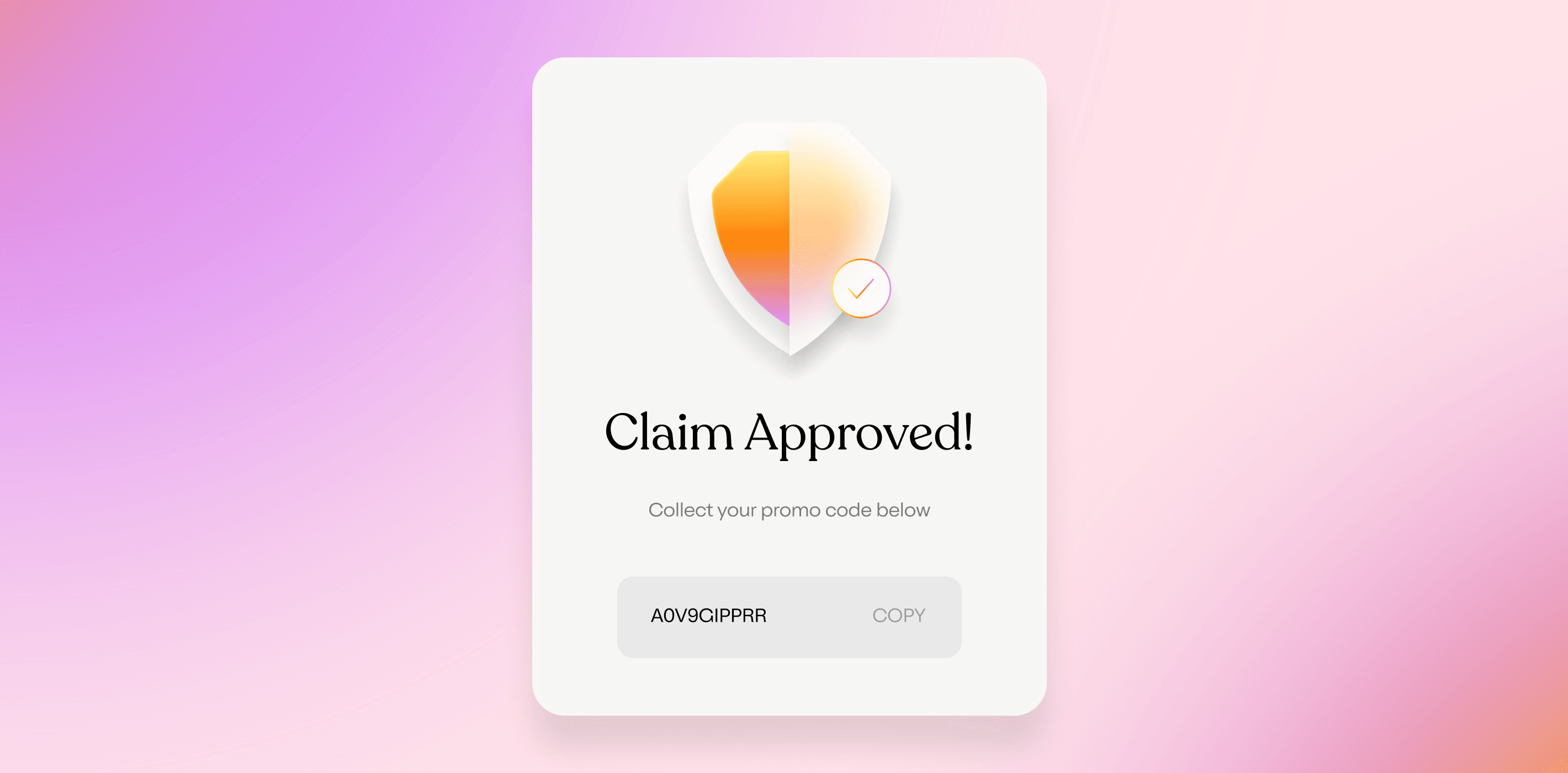

Surprise customers with instant resolutions

Clyde makes claims easy and fast. The customer submission flow is optimized for mobile and designed to turn their answers into your insights. And the best part? Claims go from zero to resolved in less than 60 seconds.

- Mobile-first interface

- Easy submission flow

- Cheetah-fast claim decisions

- Custom resolution options

Ensure positive outcomes every time, no matter what

Clyde ensures every customer has positive next steps with flexible resolution options, built-in troubleshooting, smooth handoffs to your customer support team, and thoughtfully designed customer experiences:

- Instant promo codes, payouts, or re-buying options

- Consolation discount offers (and more)

- Direct connections to repair centers

The Claims Experience

Designed for customer peace of mind

Automated for you, awesome for them. Clyde saves your customer service team precious time by giving your customers instant access to their own dashboards where they can manage their products and protection plans.

- File and resolve claims

- View contracts and terms

- Buy additional coverage

- Purchase more products

The Merchant Experience

Easily manage everything in one place

Your dashboard to maximize Customer Lifetime Value

Clyde makes all the data and actions you need available at a glance. Manage your omni-channel customer experience breezily — resend contracts, review and file claims, adjust resolutions, and so much more.

- Permission-based dashboard with unlimited seats

- Configurable email notifications

- Detailed customer claims history

- View customer LTV, NPS, and more

- Contract and claims management

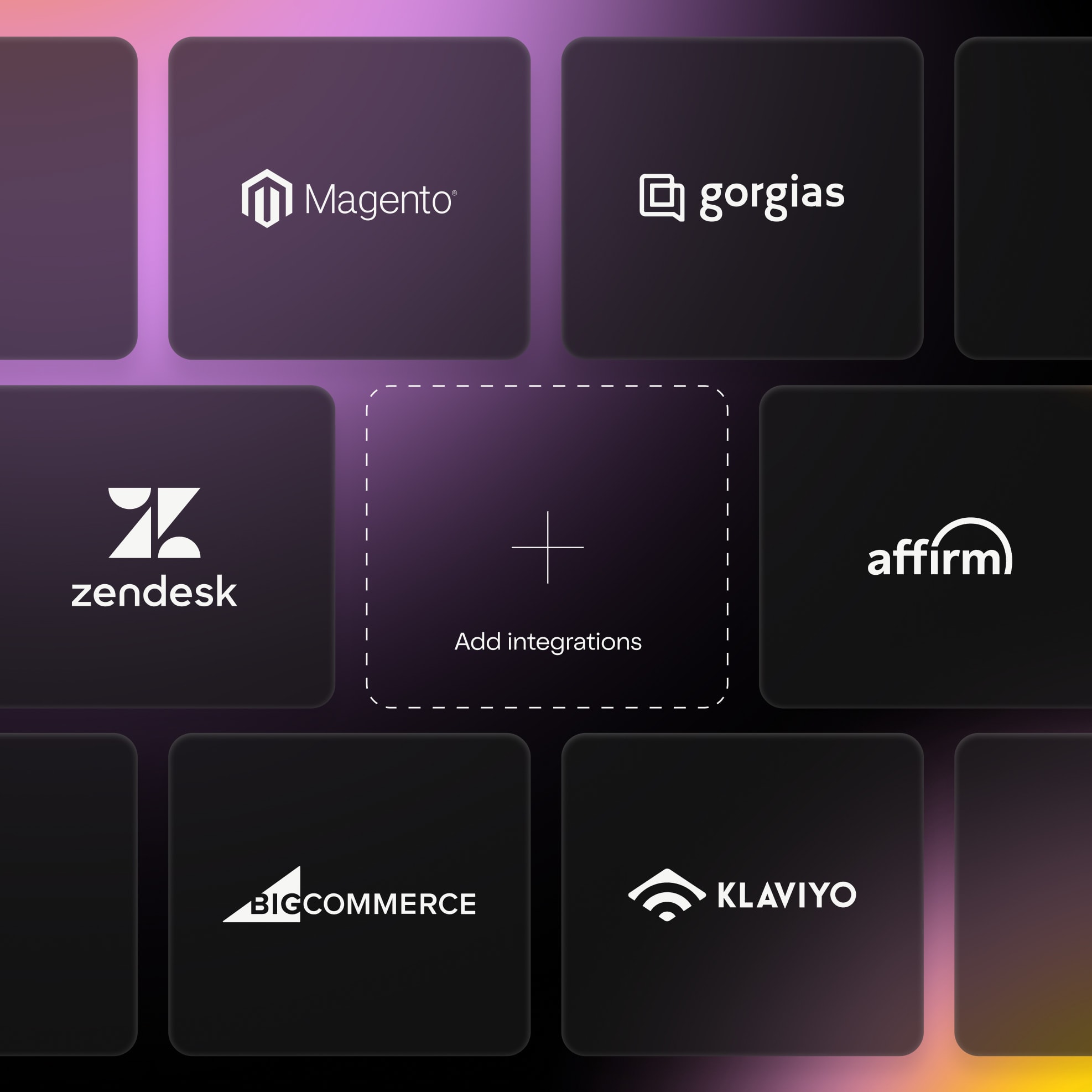

Connect Clyde to level up your ecommerce stack

Get started and accelerate quickly with our pre-built integrations and strategic agency partnerships. Our one-time catalog integration ensures all new products and variants are listed and optimized automatically.

- Integrations

- Shopify

- Magento

- BigCommerce

- Salesforce Commerce Cloud

- Klaviyo

- Agencies

- Half Helix

- Sama Labs

- Hawke Media

- Object Edge

- In Social

Elevate your ecommerce strategy with warranty data

Warranties are a window into understanding your business more deeply. Clyde collects and aggregates meaningful feedback from highly engaged customers so you have answers to questions like:

- What types of customers buy warranties?

- Why do customers make claims (vs. returns)?

- Where are products running into quality issues?

Using Registria and want to add warranties into your product registration flow?

The Merchant Experience

Easily manage everything in one place

Clyde makes all the data and actions you need available at a glance. Manage your omni-channel customer experience breezily — resend contracts, review and file claims, adjust resolutions, and so much more.

- Permission-based dashboard with unlimited seats

- Configurable email notifications

- Detailed customer claims history

- View customer LTV, NPS, and more

- Contract and claims management

Using Registria and want to add warranties into your product registration flow?

Why folks love Clyde

- Increased conversion rates

- Optimized checkout flows

- More direct shoppers

Ecommerce leads and owners

- Industry-best claims filing

- Boosted customer satisfaction scores

- Single decision-point for customer issues

Customer experience teams

- Higher customer lifetime value (CLV)

- Massive increase in high margin revenue

- Industry leading attachment rates

Finance and strategy teams

- Exceptional customer support

- Easy-to-use contract dashboard

- Fast and simple claims processing

(Soon to love you) customers

Use cases

Resources

FAQ